Introduction

The need for security against unexpected events has never been higher in our increasingly digital society, when technology affects every aspect of our lives and our valuables are frequently located in virtual locations. As a crucial defence against the dangers and vulnerabilities that come with our digital lifestyles, content insurance—also referred to as digital or cyber insurance—emerges. This blog explores the concept of content insurance, how important it is in the current day, and how the environment is changing to influence its future.

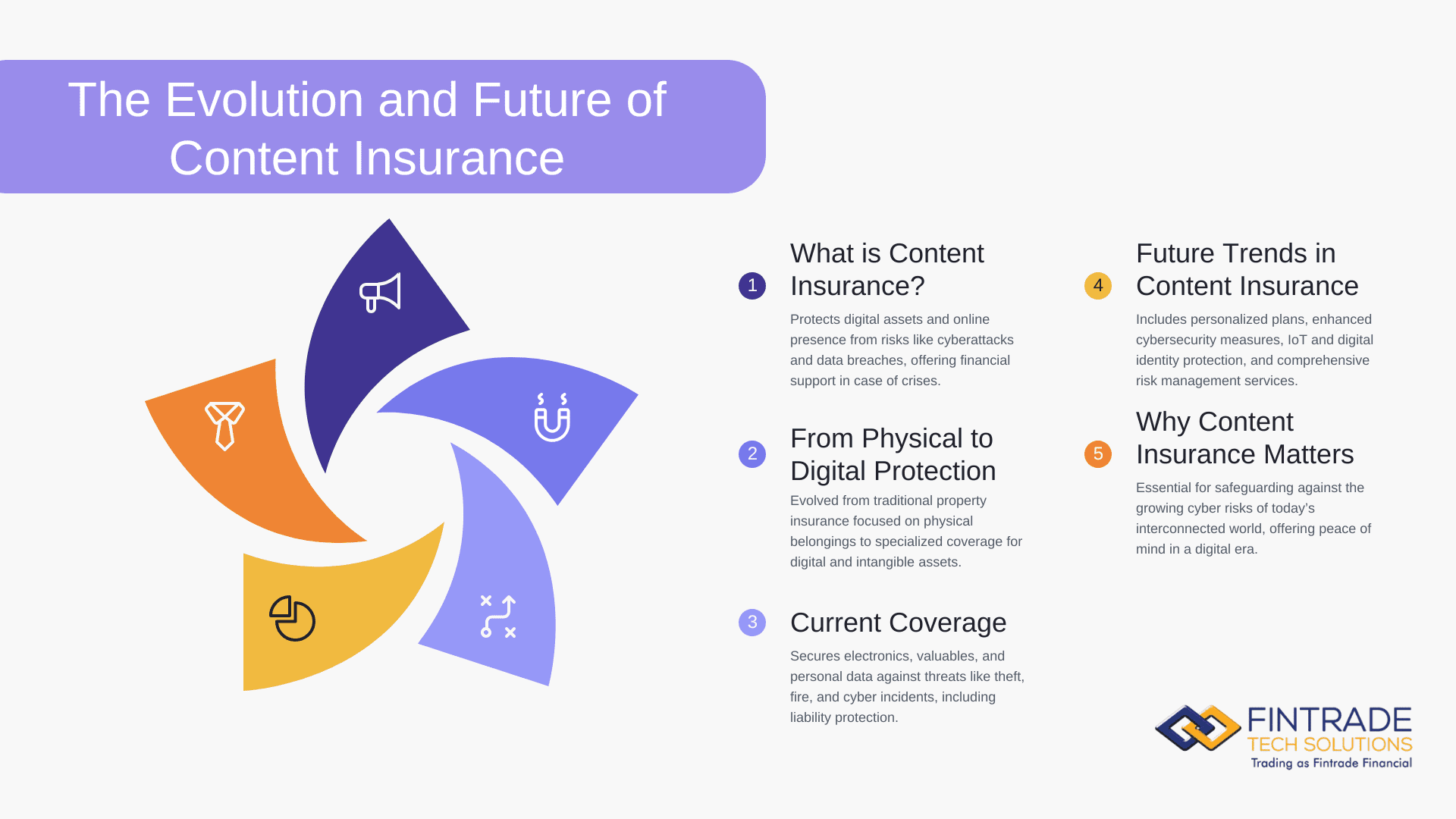

What is Content Insurance?

Fundamentally, content insurance protects your online presence and digital assets against a variety of risks, such as accidental loss or damage, cyberattacks, and data breaches. Content insurance provides protection for intangible assets like digital material, online accounts, and personal data, in contrast to standard insurance plans that mainly cover tangible goods like homes and cars. In the case of a cyber crisis, it provides cash compensation and support services, enabling people and organisations to quickly recover from digital disruptions.

The Origins of Content Insurance:

Content insurance traces its roots back to the early days of property insurance, where it primarily focused on protecting physical assets within a home. Over time, as technology advanced and our possessions became more diverse and valuable, the need for specialised coverage for personal belongings arose.

Understanding Content Insurance Today:

Today, content insurance provides coverage for a wide range of personal property, including electronics, jewellery, clothing, furniture, and more.

It typically protects against perils such as theft, fire, vandalism, and natural disasters, offering financial reimbursement for damaged or stolen items.

Many content insurance policies also include liability coverage, which protects against lawsuits arising from injuries or property damage caused by the policyholder or their family members.

The Future of Content Insurance:

As technology advances and our dependence on digital platforms grows, so do the extent and complexity of cyber threats. Content insurance’s future depends on its capacity to adapt and develop, keeping up with growing risks and providing proactive ways to reduce them. Here are some important trends influencing the future of content insurance:

Personalised Coverage:

Content insurance companies will design plans to meet the specific demands and risk profiles of people and enterprises, providing adjustable coverage choices and pricing structures.

Upgraded Cybersecurity Measures:

Insurers will collaborate with cybersecurity experts to integrate proactive security measures into content insurance policies, such as real-time threat monitoring, vulnerability assessments, and incident response planning.

Internet of Things (IoT) Protection:

With an increase of IoT devices in homes and workplaces, content insurance will broaden to include risks related with connected devices, such as privacy breaches and data manipulation.

Digital Identity Protection:

As identity theft and online fraud become prevalent threats, content insurance will encompass solutions to safeguard digital identities, authentication credentials, and online accounts from unauthorised access.

Risk Management Services:

Content insurance companies will give complete risk management services, such as cybersecurity training, breach preparation assessments, and compliance counsel, to help policyholders strengthen their cyber safety.

Conclusion:

In an era of digital innovation and interconnection, content insurance emerges as a key defence against the risks of the cyber world. Individuals and corporations may strengthen their digital defences, limit financial losses, and confidently manage the changing environment of cyber dangers by investing in complete content insurance coverage. As technology continues to alter our lives, content insurance’s future is dependent on its capacity to grow, innovate, and deliver peace of mind in an increasingly digital environment.